Which country is most proficient in payroll?

5 european countries in the spotlights

What do Belgian, French, German, Dutch and British companies have in common? Every month, it’s all hands on deck to conduct a flawless payroll. But some countries seem to be more proficient at this than others, thanks to the positive impact of certain proficiency drivers. Dive into our country reports to discover what’s what.

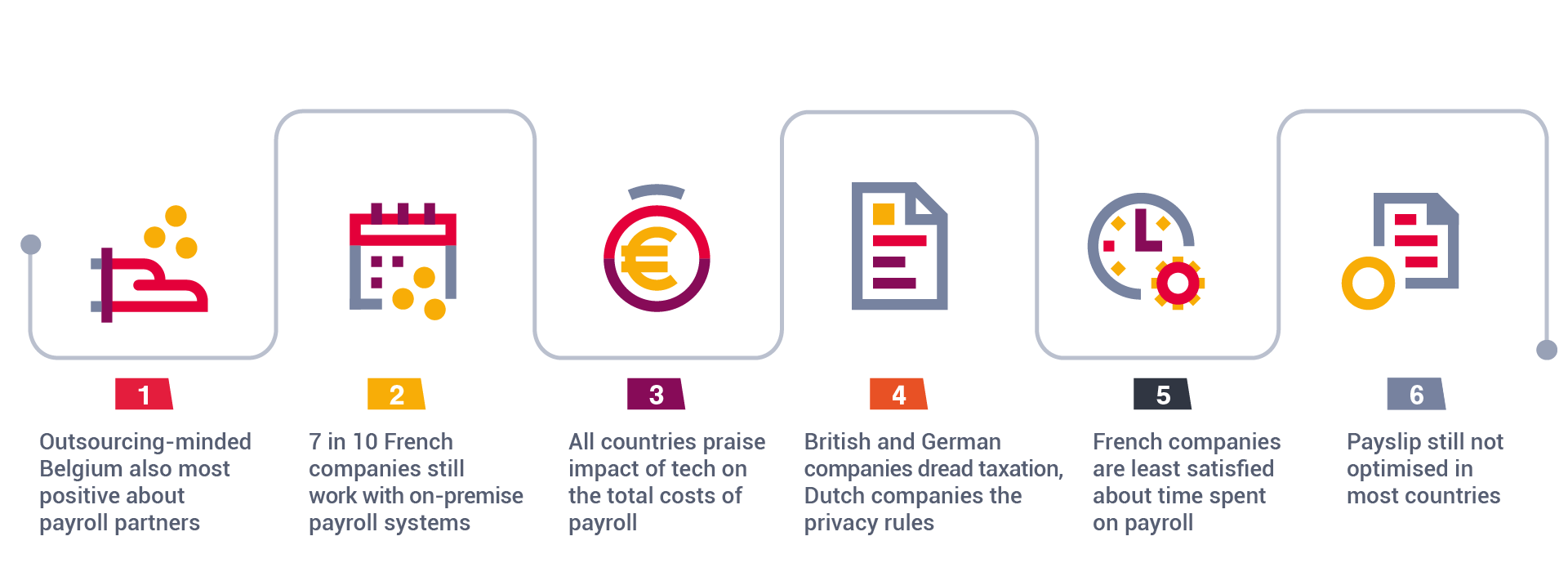

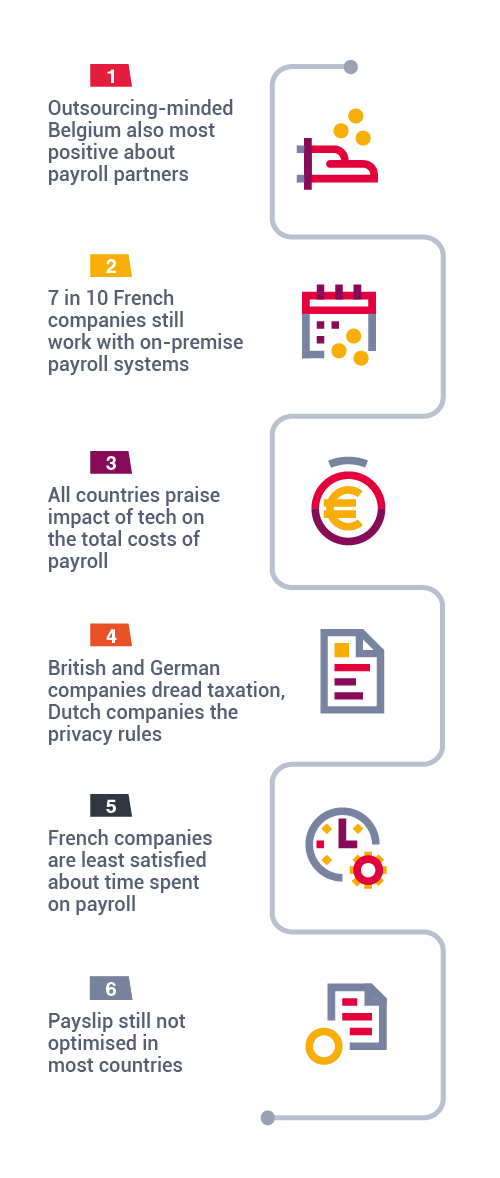

A taste of the national differences

Payroll Proficiency Index 2022: country highlights

Payroll Proficiency Index 2022: country highlights

Continuous legislative changes hold back payroll proficiency in Belgium

The speed of legislative changes is heavily linked to the multi-layered political system. To illustrate, Belgium counts 6 governments: 1 federal government and 5 regional governments. Each has its own responsibilities and powers. On top of that, there are more than 150 economic sectors, which control various labour aspects, from employers’ contributions on home-work transport to end-of-year premiums. So, it doesn’t come as a surprise that many Belgian companies turn to outsourcing to get access to the right legal expertise.

Payroll calculation in France requires vast local expertise

Over 50% of the French HR and payroll professionals consider payroll calculation one of their 5 most challenging payroll tasks – more than any other country. For example, the plethora of collective labour agreements include provisions that have a significant effect on payroll: management of sick leave, various bonuses, severance pay and much more. These conventional rules vary greatly from one agreement to another, while correct implementation requires a very high degree of technicality. In other words, vast expertise is of the essence.

German do-it-yourself approach no guarantee for payroll proficiency

No country does so much in-house as Germany when it comes to payroll. This may account for the rather low score on overall payroll proficiency. Local SD Worx experts know from experience that 1 payroll officer in Germany handles up to 800 payroll cases – sometimes even more. This results in part-time jobs and non-dedicated roles. When handling standard cases, this approach may be sufficient, but as soon as something’s off, it’s not. No wonder ‘post checks, corrections and retroactive payroll handling’ is considered the most difficult process by German companies.

HR teams in the Netherlands have raised the bar high for payroll tech

Many HR and payroll processes are highly digitised. One of the reasons is that Dutch employees expect that their interactions with HR are just as easy as booking a trip, transferring money or buying concert tickets. Strangely enough, companies don’t seem themselves as very digitally mature – less than 50% does so. A possible explanation, according to SD Worx experts, is that the bar for digital maturity is much higher in the Netherlands than in other countries. They’ve been pioneering with payroll tech for a long time and constantly challenge themselves.

Payroll in the UK has undergone transformation for the better

In the UK, the payroll rules companies need to comply with are relatively straightforward. Therefore, software and service provisions – whether in-house or outsourced – carry a robust set of standards to excel at the basics of payroll proficiency: accurate, on-time and compliant payroll. Moreover, reporting responsibilities from former manual submission obligations have changed to real-time technical solutions over the past years. This has driven UK payroll to be more technology focused and reliant on repeatable processes that are covered by the press of a button.